The online trading world has no shortage of choices, but very few brokers manage to stand out. HankoX is one of the names that has recently gained traction, thanks to its low entry requirements, competitive spreads, and the launch of its MTX4 platform in collaboration with MagnoFX. Yet, being an offshore broker, it also raises questions about trust and security. In this review, we’ll explore what HankoX offers, how it stacks up against the competition, and who might benefit most from trading here.

Company Background and Regulation

HankoX is registered in Saint Vincent and the Grenadines, a jurisdiction often chosen by brokers due to lighter regulatory frameworks. The advantage is flexibility: HankoX can offer high leverage and attractive trading conditions without many of the restrictions imposed by European or Australian regulators. The drawback is obvious — traders do not get the same investor protection or regulatory oversight as with top-tier licensed brokers. This makes it essential for anyone considering HankoX to weigh the benefits of flexible conditions against the risks of offshore regulation.

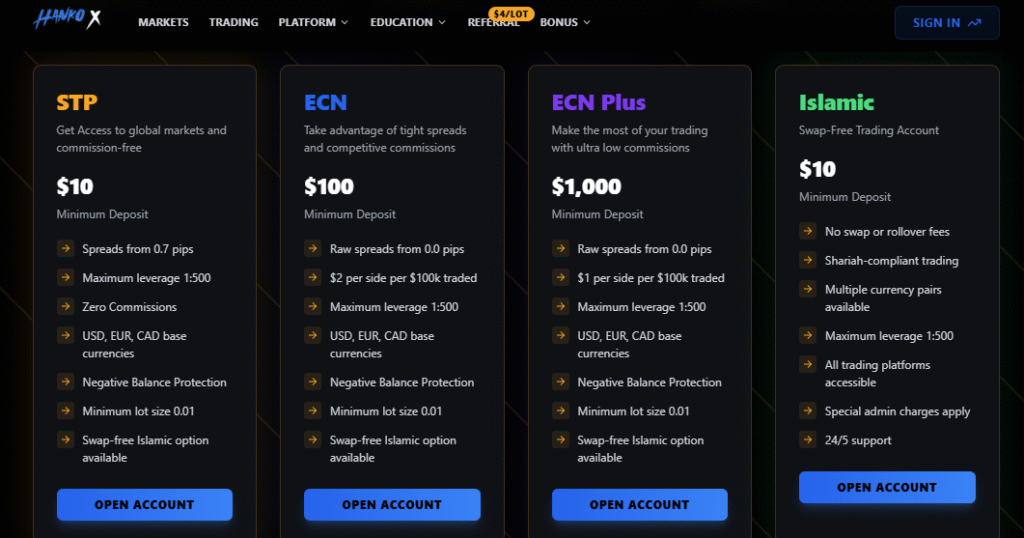

Account Types and Minimum Deposits

One of HankoX’s most appealing features is accessibility. Opening an account requires just $10, a figure that lowers the barrier for newcomers while still supporting high-volume professional trading.

The broker offers three account types:

- STP Account – No commissions, but wider spreads. Aimed at beginners who value simplicity.

- ECN Account – Tighter spreads with a small commission per lot, suitable for active traders.

- ECN Plus Account – Ultra-tight spreads and reduced commissions, best for high-frequency or institutional-style trading.

This tiered approach ensures that traders can start small and scale up without changing brokers.

Open your HankoX account with just $10. Click here.

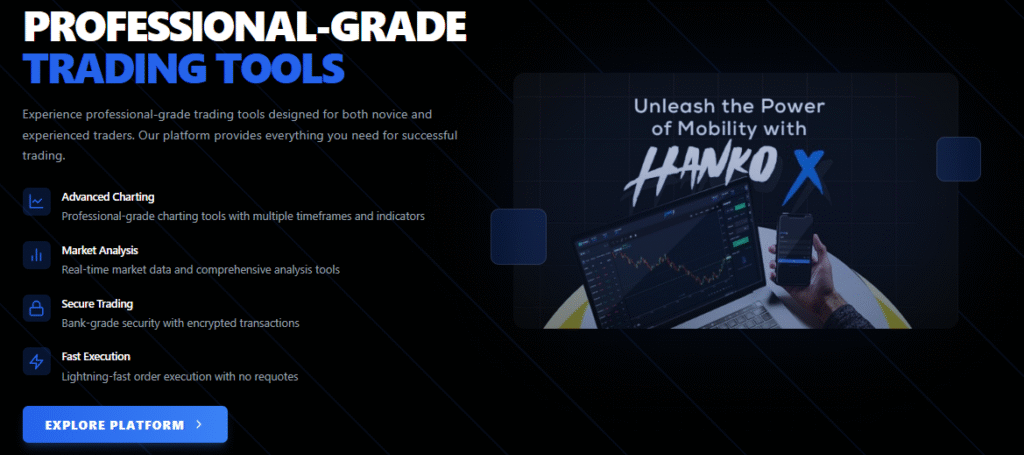

Trading Platforms: MTX4 and HankoX Web Platform

Platform choice is often where brokers differentiate themselves, and HankoX has invested in this area.

The flagship here is MTX4, developed jointly with MagnoFX. It retains the familiarity of MetaTrader but introduces refinements designed to improve execution and customization. Traders can use advanced charting, automated trading strategies, and a smooth interface that feels modern yet intuitive.

For those who prefer simplicity, HankoX also provides its proprietary web platform, accessible via any browser. It’s lighter in features than MTX4 but highly convenient for quick trades or monitoring positions without installing software. Together, these platforms cater to both seasoned professionals and casual traders.

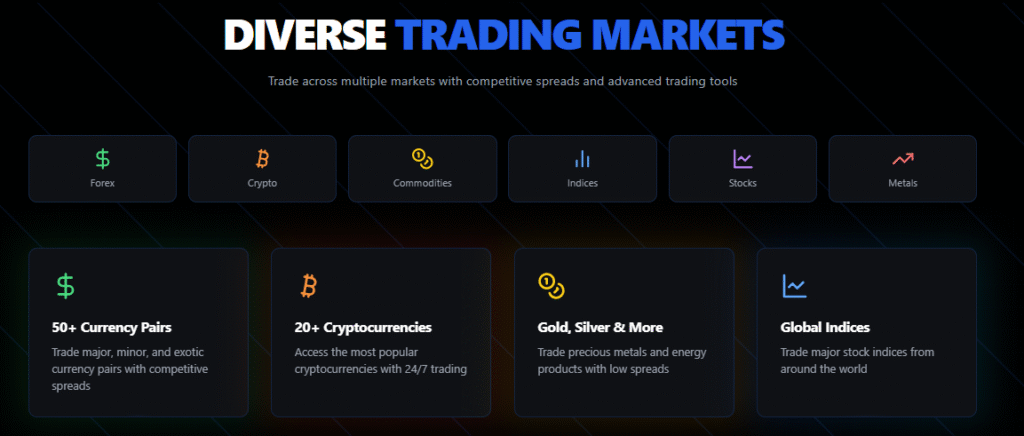

Market Instruments Available

HankoX covers the core CFD markets that retail traders expect. This includes:

- Forex pairs — majors, minors, and exotics.

- Indices — such as S&P 500, DAX, and FTSE.

- Commodities — including gold, silver, and crude oil.

- Cryptocurrency CFDs — a range of digital coins available for speculation without direct ownership.

While the offering isn’t as broad as multi-asset giants, it covers the essentials most traders use daily.

Trading Conditions: Spreads, Fees, and Execution

Pricing is where HankoX positions itself strongly. On the STP account, spreads start higher but come with zero commissions. The ECN models bring spreads down to near zero, with commissions beginning around $2 per side.

Execution speed is another highlight. Traders using MTX4 often note low latency and reliable fills, which is crucial for scalpers and algorithmic strategies. For cost-conscious traders, particularly those who trade actively, HankoX’s ECN conditions compare favorably with more established names.

Deposits and Withdrawals

HankoX has taken a crypto-first approach to payments. Deposits and withdrawals are processed through major cryptocurrencies such as Bitcoin and Ethereum, usually within 24 hours.

The advantage is speed and global access. However, traders who prefer traditional bank transfers or card funding may find the options limited. This approach will suit those already comfortable with crypto but could be a barrier for others.

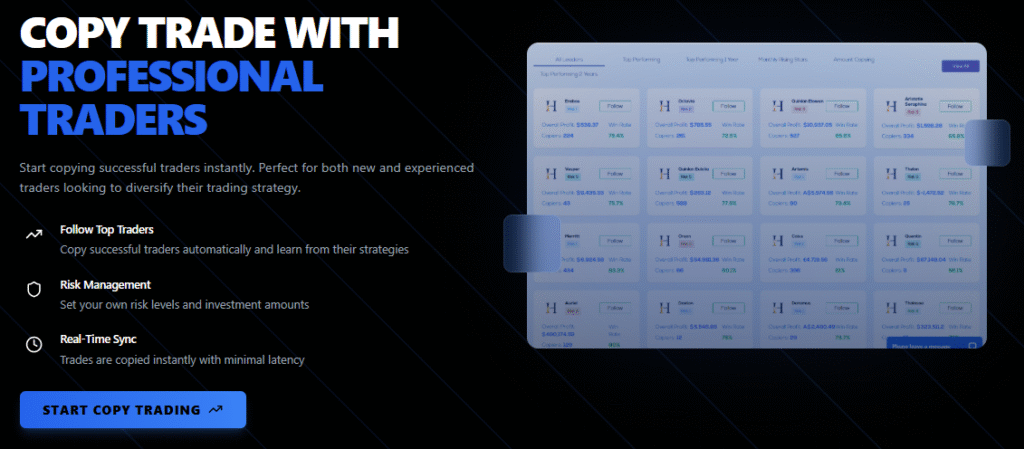

Copy Trading Features

Copy trading is available through MTX4, allowing clients to follow signal providers or link accounts to replicate strategies automatically. While not as heavily marketed as copy-focused brokers, the feature is there for beginners who want to learn by shadowing more experienced traders. It provides a bridge for those not yet confident enough to trade entirely on their own.

Education and Learning Tools

Education is an area where HankoX lags behind larger competitors. The broker provides a set of guides and occasional webinars, covering the basics of forex and CFD trading. For complete beginners, it’s a starting point, but more advanced traders may find themselves seeking additional resources elsewhere. Still, the content is useful for orientation and complements the copy trading feature for new entrants.

Bonus Programs

HankoX offers a 200% deposit bonus, designed to give traders extra margin from the start. Like all bonuses, this comes with terms and conditions, typically requiring a certain trading volume before withdrawal is allowed.

For traders who understand the rules and trade actively, the bonus can be a welcome boost. However, beginners should be cautious about over-leveraging.

Affiliate and Partnership Opportunities

Beyond trading, HankoX runs an affiliate and Introducing Broker (IB) program.

Partners can earn commissions by referring new clients, with flexible revenue-sharing models available. For influencers, trading educators, or community leaders, this provides an opportunity to monetize networks while aligning with a broker that emphasizes competitive trading conditions.

Pros and Cons of HankoX

Strengths

- Competitive spreads, particularly on ECN accounts.

- MTX4 platform developed with MagnoFX plus a simple web trader.

- Low $10 minimum deposit.

- Fast crypto-based funding.

- Generous 200% deposit bonus.

Weaknesses

- Offshore regulation may deter risk-averse traders.

- Limited payment methods beyond crypto.

- Smaller range of educational resources.

- Market coverage not as broad as multi-asset brokers.

Who Should Consider HankoX?

HankoX is best suited for traders who prioritize cost-efficient trading and flexibility over regulatory reassurance. Scalpers and algorithmic traders will appreciate the tight spreads and execution speed on MTX4, while beginners may be drawn to the low minimum deposit and STP account simplicity.

It is less ideal for those who prefer traditional deposit methods, comprehensive education, or the peace of mind that comes with top-tier regulation.

Final Verdict

HankoX is not aiming to be the largest broker on the market, but it does deliver on its core promises: low entry costs, competitive spreads, and fast execution on a modern platform. The offshore registration and crypto-only funding may raise eyebrows, but for the right kind of trader, cost-conscious, active, and comfortable with risk, HankoX provides a lean, effective trading environment.

For traders who value flexibility and raw trading conditions over brand recognition, HankoX is worth considering.