I work at NGO Experts. I help groups get legal status. In this post I explain 12a registration in simple words. I keep steps clear. I use short sentences. I want you to feel confident.

Why 12a registration matters

First, 12a registration gives tax recognition. It helps donors trust you. Also, it helps you get tax exemption under the Income Tax Act. Therefore, you can focus money on your work. For example, schools and health programs use this benefit. In short, 12a registration supports sustainability.

Who should apply

If you run a trust, society, or section 8 company, you may apply. Next, check that your activities are charitable. I advise you to keep clear aims and records. Also, make sure your governing document matches your work. Finally, consult a legal guide if you feel unsure.

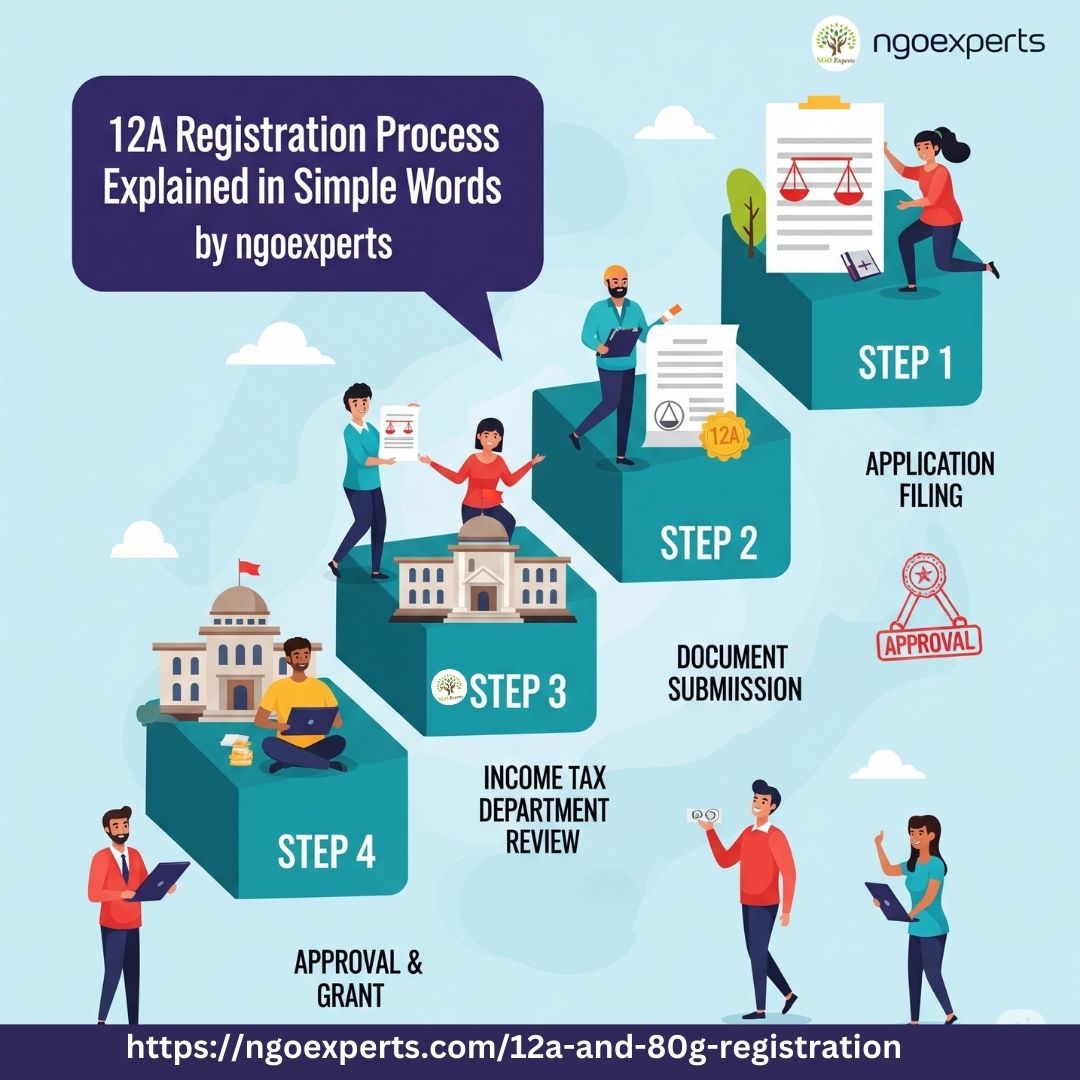

The step-by-step 12a registration process

First, gather documents. You will need the trust deed, memorandum, PAN, identity proofs, and bank details. Next, prepare the application form. I suggest writing a clear activity report. Then, fill Form 10A or the relevant online form. Also, attach the charter and the financial plan. After that, submit to the tax office with a covering letter. Finally, respond quickly to any queries from the tax officer.

How this links with the procedure to start a ngo

When you learn the procedure to start a ngo, plan for 12a from day one. First, register your entity as a trust, society, or company. Next, get a PAN and open a bank account. Then, maintain minutes and receipts. Also, create a simple yearly plan and budget. Because of this, 12a registration becomes easier. Therefore, good records speed up approval.

About darpan ngo registration

Also, consider darpan ngo registration for digital presence. Darpan connects NGOs with government schemes. I recommend completing darpan ngo registration early. It helps with transparency and fund access. Moreover, many donors check Darpan details before they give. So, register on the Darpan portal and keep your profile updated.

After you get 12a approval

Once you receive approval, keep records. I file yearly returns on time. Also, I update activity reports. Next, use tax benefits to grow projects, not to idle funds. Finally, inform donors and partners about your status. This builds trust and brings more support.

Common mistakes to avoid

First, do not submit vague aims. Next, avoid poor records. Also, do not delay responses to the tax office. Finally, avoid missing signatures or wrong names. If you need help, ask a legal expert.

Tips for faster approval

Additionally, prepare a clear note on how funds will be used. Furthermore, get your trustees’ IDs ready. Meanwhile, ensure your bank account name matches your organization name. Also, attach audited accounts if available. Before submission, double-check all names, PAN, and addresses. After submission, follow up politely. Because officers get many files, a timely follow-up helps. Consequently, you may get quicker clearance. If queries come, answer them within a week. Lastly, keep digital copies of everything.